- Group’s 1H2021 revenue at S$192.3 million is second highest 1H after record

breaking 1H2020 - Next generation handlers on track to start high volume ramp at customer sites in late 3Q 2021 and into FY2022

- Technology acquisitions and in-house R&D bearing results with engineering engagements with 10 out of the top 20 semiconductor companies for potential volume ramp in FY2022 are on track

- AEM remains confident of a strong uptake in 2H2021 into 2022 and maintains its revenue guidance of S$460 – S$520 million for FY2021

- CEI Limited (‘CEI’) became a subsidiary of the Group with effect 19 March 2021 and was delisted from the Singapore Exchange Securities Trading Limited following the acquisition of 100% equity interest in CEI on 30 June 2021

- On-going integration with CEI’s business, with plans to realise synergies and expand the Group’s capabilities to bring value to customers

- The Group proposed an interim dividend of 2.6 Singapore cents per share, representing a payout of about 25%

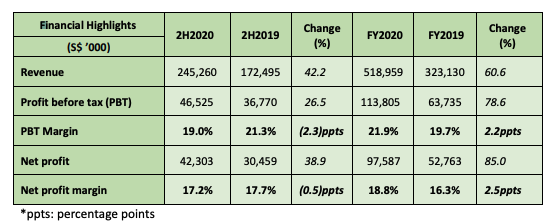

Singapore, 5 August 2021 – AEM Holdings Ltd (“AEM†or “the Groupâ€), a global leader offering application-specific intelligent system test and handling solutions for semiconductor and electronics companies serving advanced computing, 5G and AI markets, announced its financial results for the six months ended 30 June 2021 (“1H2021â€) today.

| Financial Highlights (S$ ’000) | 1H2021 | 1H2020 | Change (%) |

|---|---|---|---|

| Revenue | 192,251 | 273,699 | (29.8) |

| Profit before tax (PBT) | 35,510 | 67,280 | (47.2) |

| PBT Margin | 18.5% | 24.6% | (6.1)ppts |

| Net profit | 29,696 | 55,284 | (46.3) |

| Net profit margin | 15.4% | 20.2% | (4.8)ppts |

The Group achieved revenue of S$192.3 million for 1H2021 with 53% revenue from consumables and services, 26% from tools and machines and 21% from others.

AEM reported net profit of S$29.7 million for 1H2021, with a net profit margin of 15.4%. Fully diluted earnings per share for 1H2021 was 10.52 Singapore cents, compared to 20.13 Singapore cents for 1H20201.

Cash and cash equivalents were at S$70.9 million as at 30 June 2021 as compared to S$134.8 million as at 31 December 2020, largely due to (i) acquisition of a subsidiary, an associate and other investment (S$81.7 million) (ii) dividends payout of S$11.2 million and (iii) net cash used in operating activities of S$13.5 million, partially funded by external borrowing of S$50.0 million.

Net asset value per share was 87.6 Singapore cents as at 30 June 2021, compared to 76.7 Singapore cents as at 31 December 2020.

The Group proposed interim dividend of 2.6 Singapore cents per share, representing a payout of about 25% for 1H2021.

Business Overview and Outlook

The Group’s mission is to provide the most comprehensive semiconductor and electronics test solutions based on the best-in-class technologies, processes, and customer support. Innovation with agility of execution enables the Group to drive customer success.

The Group continues to expand its technology and platform offerings, delivering more value across to its customers. The Group has constantly expanded its application specific test solutions through R&D and M&A. In its endeavour to realise its SLT+ vision and command a leadership position in the industry, AEM recently completed the acquisition of CEI Limited and the partnership with ATECO Inc., on top of the six other acquisitions made by the Group since 2017. With the enhanced business model, the Group now offers a full suite of application specific test solutions across MEMS, wafer sort, packaged ICs and RF interconnects with enhanced delivery capabilities.

The industry has been witnessing investments/capex from the front-end players. These developments will lead to additional investments in back-end test in subsequent quarters thereby expanding the Group’s addressable market.

AEM will continue to capitalise on global trends such as 5G, edge computing, AI, and vehicle electrification, along with increase in heterogenous packaging to deliver highly differentiated test solutions to increase its market share globally.

The ongoing supply chain disruptions experienced by many companies in the industry continues to be a challenge for order fulfilment. The Group is working with its suppliers to secure the parts and components to meet its shipment plans.

AEM’s CEO Chandran Nair commented, “The semiconductor industry is navigating through an extraordinary period of surge in demand, rapid technology change and at the same time facing supply shortages. The recent wave of lockdowns across major economies has set lead times to record highs. Innovation and agile companies like ourselves will be at the forefront of growth.

In terms of demand for our products and solutions, we are anticipating a strong uptake in the later part of 2H2021 into 2022 as our next generations tools are phased into our customer’s High Volume Manufacturing sites globally. Thus, we are keeping our FY2021 revenue guidance of S$460 – S$520 million.

We are also pleased with our progress of deep technical engagements with 10 out of the top 20 global semiconductor companies, spanning mobility, memory, and high-performance computing. We are hopeful to achieve meaningful revenue from these engagements in 2022.â€

References

- Based on the weighted average number of shares adjusted for the effect of dilutive potential ordinary shares of 280,795,363 for 1H2021 and 274,647,817 for 1H2020 respectively